The history of “The Italian Sea Group” begins in 2009, when “GC Holding S.p.A.”, a company headed by entrepreneur Giovanni Costantino, acquired 100% of “Tecnomar S.p.A.”. After that, in November 2011, the group acquired the “Admiral” brand, expanding its offering with the aim of entering the large-scale market. The rapid growth in the number of contracts and the increase in the size of the active orders highlighted the need to invest in a larger production site with direct access to the sea. For this reason, in 2012, “GC Holding S.p.A.” acquired 100% of “Nuovi Cantieri Apuania S.p.A.” (now “The Italian Sea Group S.p.A.”), which produced and still produces commercial and cruise ships within the Marina di Carrara shipyard.

The production site in Marina di Carrara, now the headquarters of TISG, has been active since 1942 and, even then, had cutting-edge facilities that allowed the production of medium and large ships. The acquisition of the shipyard allows the maintenance of employment and the relaunch of a company with a recent past as a protagonist in large-scale shipbuilding, expanding production capacity and retaining the precious specialized "know-how" in the specific industry segment. This was followed by important investments in the renovation and expansion of the headquarters, the organization of the areas dedicated to new production, the construction of a steelworks and an upholstery factory and the expansion of the areas dedicated to refit activities, started in 2015.

Since 2020, investment plans have been approved, aimed at further increasing the production capacity of the shipyard. The Marina di Carrara headquarters currently covers an area of approximately 120,000 square meters and boasts an absolutely strategic position, in particular for refit activities. Situated on the Mediterranean, a short distance from important Italian tourist and recreational destinations (therefore a privileged stop for yachts in the summer season), the shipyard is equipped with cutting-edge facilities and entertainment spaces for crews which, combined with the skills of the management and the quality of the services, allow the Group to represent an important point of reference for shipowners and captains from all over the world.

In 2021, the Company entered the Italian stock exchange and, on June 8th, the trading of TISG.MI shares began on "Euronext Milan", a regulated market managed by "Borsa Italiana S.p.A." On December 22, 2021, through its 100% subsidiary "New Sail S.r.l." (later merged by incorporation into the parent company) acquires “Perini Navi S.p.A.” at the bankruptcy auction announced by the Court of Lucca, for 80 million euros. The acquisition includes the real estate complex of the Viareggio and La Spezia shipyards, a real estate complex in Pisa, the “Perini Navi” and “Picchiotti” brands, the patents, the shareholding in “Perini Navi USA Inc.” (a company extinguished in 2024) and the existing legal relationships with employees and third parties. In 2023, TISG sells the Perini Navi office building and, in June 2024, finalizes the sale of the shipyard, both located in Viareggio.

In 2022, The Italian Sea Group completed the acquisition of 100% of the shares of “TISG Turkey Yat Tersanecilik Anonim Sirketi” (“TISG Turkey”), a company through which TISG controls and supervises the hull and yacht carpentry activities it carries out in Turkey. This operation allows the Group to consolidate the entire production process, ensuring even more integrated management of operations. With a view to continuously internalizing the key activities of the production chain (which also includes the acquisition of “CELI” in 2023 and “NCA Refit”), in June 2024 TISG inaugurated a new business unit within its headquarters in Marina di Carrara dedicated to steelworks for interior finishes, an activity with very high added value. On July 29, 2024, Borsa Italiana awarded the Company's shares the STAR qualification, admitting them to trading on the STAR segment of Euronext Milan starting from August 6, 2024.

The Italian Sea Group has become one of the most renowned companies in the international nautical sector, an absolute point of reference in the design and construction of yachts up to and over 100 meters. It has become a 100% Made in Italy reality, which, from 1575 to today (03/11/2024), has seen the launch of 1289 yachts.

As previously mentioned, the core of The Italian Sea Group’s activity is the design and construction of large, highly customized and top-quality yachts. The company operates through different brands, each with its own identity and specialization:

- Picchiotti, specialized in “sailing yachts” and “explorer yachts”;

- Admiral Yacht, focused on “motor mega-yachts”, characterized by sporty and innovative lines;

- Perini Navi, historic brand specialized in large “sailing yachts”;

- Tecnomar, dedicated to the production of sportier and more performing “motor yachts”;

- Tecnomar for Lamborghini 63, the most iconic and innovative model of the entire range, born from the collaboration with Lamborghini, this vessel represents a perfect union between the world of supercars and that of sailing;

- NCA Refit, specialized in the renovation and refitting of existing boats;

- Celi Interiors, focused on the creation of luxury interiors for yachts;

The Italian Sea Group stands out for its ability to produce completely customized yachts, capable of satisfying the most exclusive requests of its customers. The company pays great attention to the quality of materials and finishes, using only high-quality materials and craftsmanship. Design plays a fundamental role in the success of The Italian Sea Group, in fact the group collaborates with the best international designers to create unique and cutting-edge products. Technological innovation is another pillar of the company strategy, the group invests heavily in research and development to integrate the latest technologies into its yachts, improving performance, comfort and safety. The company is also very attentive to environmental issues and is developing innovative solutions to reduce the environmental impact of its products. Also noteworthy is the management of the company's distribution channels, in fact The Italian Sea Group sells its yachts directly to private customers, through a global sales network, collaborating with brokers specialized in the sale of luxury yachts, participating in the main international events and boat shows to promote its products and to meet potential customers.

The TISG group recorded Operating Revenues of 189.8 millions of euros as of June 30, 2024, this number grew by 17% compared to the 162.5 million of euros recorded in the 2023 financial year. In particular, these operating revenues come from two main sectors, Shipbuilding and Refit, reflecting the following breakdown:

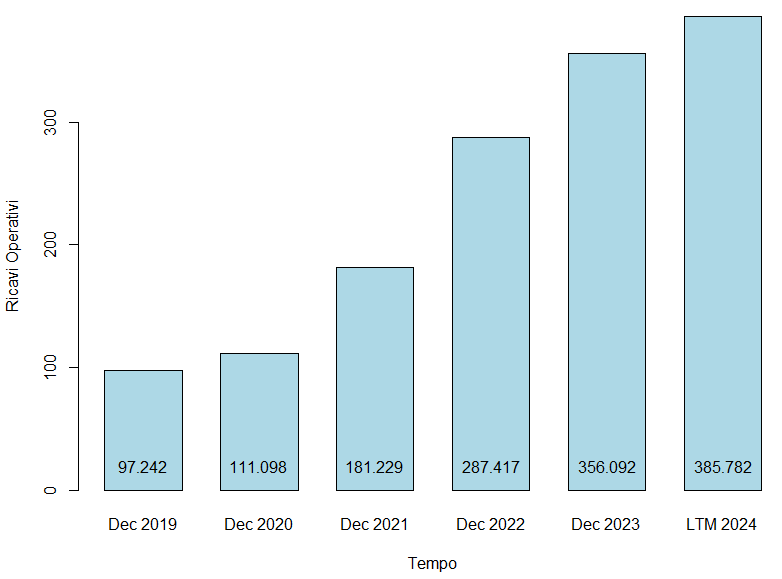

The trend of annual Operating Revenues in the last 5-6 years is growing, in fact, considering the results shared in the period from 2019 to November 10, 2024, they grew with a CAGR of 37.74% and recorded a Total Growth of 482.08%. The LTM value of operating revenues is currently at 356.8 millions of euros.

The Shipbuilding division’s operating revenues amount to 167.16 millions of euros as of June 30, 2024, a value that is up 25% compared to the 139.47 millions of euros in the first half of 2023. Considering the Geographic division, 52% of these revenues come from the Americas, 35% from Europe and the remaining 13% from Asia Pacific.

The Refit division’s operating revenues, on the other hand, accounts for a total of 22.67 millions of euros as of June 30, 2024, a value slightly down compared to the 23.03 millions of euros recorded in the first half of 2023 (Refit revenues are subject to seasonality, usually they see an acceleration in the second part of the year). Considering the Geographic division, these revenues come for 54% from Asia Pacific, for 23% from Europe and for the remaining 23% from the Americas.

Operating Profit also shows a growth trend in the last 5-6 years, in fact, considering the results declared in the period from 2019 to 10 November 2024, it grew with a CAGR of 58.34% and recorded a Total Growth of 1153.34%. The LTM value of operating profits is currently equal to 51.65 millions of euros.

In 2023 the group recorded a Free Cash Flow of 23.11 millions of euros, a value however decreasing in the last 12 months, since the LTM value recorded is 10.63 millions of euros. Here is a graph that relates Free Cash Flow with Cash from Operations, Cash from Investing and Cash from Financing with data from December 2019 to the months LTM, in millions of EURO.

Note, the Cash from Financing (or Cash Flow from Financing) is in a clear negative position both in 2023 and in the past 12 months.

The Profitability Indicators for the TISG group, namely ROI (Return on Invested Capital), ROA (Return on Assets) and ROE (Return on Equity), have been growing overall in recent years. In particular, considering the quarters from March 2023 to September 2024, ROI has grown with a CAGR of 58.73%. This graph shows the three indicators previously mentioned, compared with the Price/Earnings Ratio (P/E - Price/Earnings Ratio), in the period previously considered. In September 2024, the P/E ratio reached a value below double digits, recording 7.56.

As of June 30, 2024, the TISG group has a negative Net Financial Position of 33.69 millions of euros. According to their statements, part of this value derives from financial contracts characterized by financial covenants. The group is therefore exposed to the risk of having to repay its financial debt early if specific circumstances occur. This risk could determine clear negative effects on their economic, financial and equity situation.

The Italian Sea Group is also exposed to changes in interest rates, in fact it risks that the increase in "interest rates" may lead to greater charges than the current ones. In order to cover this risk, the group adopts hedging instruments for the most significant medium and long-term loans, at variable rates.

According to the latest update of the Global Industry Classification Standard (GICS) drawn up by MSCI and Standard & Poor's (S&P) in 2023, the classification of the reference industry, relating to The Italian Sea Group, is as follows:

- The company falls within the Industrials Sector;

- The company falls within the Capital Goods Industrial Group;

- The company falls within the Machinery Industry;

- The company falls within the Construction Machinery & Heavy Transportation Equipment Sub-Industry;

Consequently, its reference code is 20106010. According to this classification, this category is made for companies specialized in the production of heavy trucks, rotating machinery, earthmoving machinery, construction machinery, naval machinery (non-military) and related parts. In particular, the group is specialized in the production of non-military naval machinery with a length equal to or greater than approximately 50 meters, also considering the production of related parts and services.

Excluding The Italian Sea Group, the Italian group Sanlorenzo and the Italian group Ferretti Group are good examples for the above-mentioned category. There are also other companies to observe not necessarily in details, such as the Italian group Azimut-Benetti (not listed on the stock exchange separately from Azimut, which is a group of financial companies), the French group Beneteau (which produces naval machinery with a length of less than 12 meters), the French group Catana (which produces naval machinery with a length of less than 20 meters), the German group Lürssen (not listed on the stock exchange) and the German group Blohm+Voss (also not listed on the stock exchange). In the following table you can find their main declared information, compared:

The Yacht market has reached a total value of 12 billion USD in 2023 and, according to some research, it is expected to record a CAGR growth of 7% between 2024 and 2032, reaching a value just over 21 billion USD. Having said that, we must also consider the growth factors declared in the various research, which are small. All the research we consulted cite as main factors only the increase in the number of "wealthy" individuals and the increase in market demand in the luxury tourism sector, especially in Europe and North America.

In specifically, the TISG group also looks at the market with largely positive future prospects, in fact the growth objectives of the group foresee revenues between 400 and 420 millions of euros for 2024 with an EBITDA Margin between 17 and 17.5%, while for 2025 they foresee revenues between 430 and 450 millions of euros with an EBITDA Margin between 18 and 18.5%. An interesting comparison to add and consider, as regards TISG and the two main companies previously mentioned (Ferretti Group and Sanlorenzo), concerns the choice of the Dividend to be paid to shareholders, The Italian Sea Group has confirmed its intention to distribute an annual dividend with a payout of around 40-60% of Net Profit, confirming itself in line with competitors, who in 2023 distributed dividends equal to these percentages.

Another important aspect to discuss concerns the Porter’s 5 Forces model in relation to the TISG company, they can be argued as follows:

- Competitive rivalry:

The luxury yachting sector is characterized by strong competition and rivalry between a limited number of high-level shipyards. Companies such as Sanlorenzo, Lürssen, Benetti and other groups, which have been previously mentioned, compete directly with The Italian Sea Group, constantly trying to improve their offering, in order to compete for an increasingly larger market share. Competition is especially based on product differentiation, design, quality of materials, customization and exclusivity. The TISG group stands out for its ability to offer a wide range of yachts and naval vessels, from classic to the most innovative models; It is especially renowned for its attention to detail and its special market offering, which mainly includes luxury naval vessels with a length equal to or greater than 50 meters.

- Threat of new and potential entrants:

The barriers to entry in the sector of large luxury naval vessels are very high, requiring significant investments in infrastructure, specialized technologies and highly qualified skills. Furthermore, to successfully enter this market it is necessary to establish consolidated relationships with a demanding clientele and a network of specialized suppliers.

- Threat of potential substitute products:

Essentially, there are no direct substitute products for super-yachts or luxury naval vessels in general. However, in the long term new trends in the luxury tourism sector could emerge, super-yacht charters or cruises on luxury explorer ships can be an example, these trends could in fact represent a form of indirect competition, being very often cheaper and more practical options. Ultimately, it will all depend on the market and demand, and, precisely with regard to this threat, the TISG group seems to be very observant to market changes.

- Bargaining power of customers:

Buyers of superyachts are generally few and very wealthy, with highly customized needs. This gives customers strong bargaining power. However, both the limited availability of shipyards capable of building large superyachts and the practical difficulty of purchasing this type of luxury goods, relatively limit the buyers’ bargaining power. In our specific case, The Italian Sea Group has an excellent relationship with customers, which makes their bargaining power lighter.

- Bargaining power of suppliers:

Usually, suppliers of specialized components and materials for the construction of large luxury naval machines have a certain bargaining power, especially for unique components. However, The Italian Sea Group, being a large customer, can negotiate favorable conditions with suppliers; but above all, the TISG group has begun to create its own independence in sourcing the components needed for its production chain (an example of this is the recent acquisition of CELI, which is among the most important strategic suppliers of the group, as it produces a large part of the furnishings, both internal and external, of the yachts under construction).

A final notable point to consider concerns CELI s.r.l., in fact the TISG group, through the recently acquired company, has the opportunity to expand its business in real estate and high luxury hospitality, if there is demand from its customers. This opportunity would improve the diversification of the company's business, leading, in a positive perspective, to greater revenues and consequent profits, always remaining in the luxury market.

Talking about the ESG attention, the growing awareness of environmental impact has led the nautical sector to undertake a transition towards more sustainable practices. The demand for low environmental impact boats, especially from a clientele that is increasingly attentive to sustainability issues, is driving a profound change in the sector. The adoption of innovative technologies, the use of eco-friendly materials and the implementation of efficient resource management strategies are representing the main levers for reducing the environmental impact of the sector. All this in line with international programs (Paris Agreement and European Green Deal) dedicated to setting gas reduction targets to combat climate change. On its main website, the TISG group states that: “For The Italian Sea Group, Social Responsibility is not only an inspiring principle, but the strategic foundation of our business. Every day we are committed to acting responsibly to build a more sustainable world, for today's and future generations.” In fact, on 5 July 2024, the Group obtained an ESG rating of A from Cerved Rating Agency, up from the previous BBB rating, placing it above the median of the reference sector. The rating upgrade was also supported by the achievement of the objectives of the three-year ESG Plan, which was finalized in 2022 with the publication of their first Non-Financial Statement. In particular, the significant increase in employee training hours, the mapping of the supply chain based on sustainable criteria, the effective containment of direct impacts on the environment, the increase in the use of renewable energy and greater control of emissions. The Italian Sea Group appears to be positioned as one of the leading players in the luxury yachting sector that demonstrates a strong commitment to Environmental, Social and Governance (ESG) Sustainability.

Considering all of this and given the brands, the characteristics of the company and their potential, TISG.MI can be classified among the leading companies in its sector.